How big is Your Credit Card Debt?

If you are like most people I know, you have a certain amount of credit card debt. Credit card companies make thousands of dollars off the backs of everyday working people who struggle to pay massive interest charges and never seem to get any closer to being out of debt.

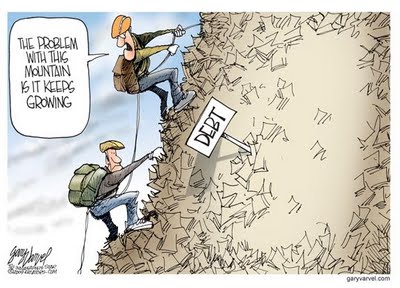

Credit card debt is a vicious cycle, and plenty of people get caught up in it and cannot get out of the endless cycle. The higher the balance you carry, the more interest you pay on that balance. If you are only paying the minimum payment, then you may be simply paying interest charges and nothing more.

The way credit cards are supposed to be used is that you purchase items on your credit card and then pay off the balance each and every month. Most people cannot pay the entire balance at one time, and for people who get caught up in the debt cycle, it can be years before they manage to pay off their credit card debt.

This is exactly what credit card companies want from consumers. They like consumers that carry a large balance and pay interest perpetually. This is how they make a large amount of money on the backs of consumers who do not have the ability to pay off their credit cards.

If you have a lot of credit card debt and have lost your job or the ability to pay that debt, then you probably already feel the crunch. It can be pretty disheartening to see no difference in the balance on your credit card statements each month. The harder you try to pay off the balance, the harder it seems to become.

You may find yourself borrowing money from one credit card to pay another credit card, and even worse, taking out a new credit when your credit cards are at their limit or over their limit. You will only be able to sustain the balances for a certain amount of time before it becomes painfully obvious that you have lost control of your credit cards.

If you have completely lost control of your credit card debt, then there are only a couple of options open to you if you are finding it impossible to pay off that debt. The first option is for you to declare bankruptcy, but if you go this route you may find it impossible to repair your credit in the future. The mark of bankruptcy can follow you for life and make it difficult for you to get a job, buy a car, buy a house; in short, it makes your life miserable.

The other option is to contact a credit counseling agency. Credit counselors are professionally trained to negotiate on your behalf. What they will do is meet with you, discuss what your total debt load is, and how much you can afford to pay each month. From that point, they will contact all of your creditors and negotiate a reduced debt and interest rate that you can pay off in a reasonable amount of time.